virginia estimated tax payments 2021 forms

Install the signNow application on your iOS device. _____ Check if this is a new address.

We last updated Virginia Form 760ES-2019 in February 2021 from the Virginia Department of Taxation.

. This form is for income earned in tax year 2021 with tax returns due in April 2022. You must pay at least the minimum amount calculated using the instructions to avoid being penalized. See important information for NYC residents with city taxable income of 500000 or less.

At present Virginia TAX does not support International ACH Transactions IAT. Log in and select Make an Estimated Payment. Tax return you are required to make estimated tax payments using this form.

Enter beginning date 20 ending date 20 and check here. Click IAT Notice to review the details. Payment Voucher 1 by May 1 2021.

To sign a 2021 form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents right from your iPhone or iPad just follow these brief guidelines. Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. Use Form 1040-ES to figure and pay your estimated tax for 2021.

IT-2106 Fill-in IT-2106-I Instructions Fiduciaries. If the ending month for the taxable year of the corporation is March 2021 enter 03 21. Enter your Virginia account number the ending month and year for the entire taxable year calendar fiscal or short taxable year for which the estimated payment is made not the ending date for the quarter the estimated payment is made.

Estimated Income Tax Payment Voucher. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Estimated tax payments must be sent to the Virginia Department of Revenue on a quarterly basis.

Payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. This includes estimated extension and.

Please enter your payment details below. However you may pay more than the minimum if you wish. Please note a 35 fee may be.

Payments due April 15 June 15 September 15 2020 and January 15 2021. Make estimated payments online or file Form 760ES. You can print other Virginia tax forms here.

1 PDF editor e-sign platform data collection form builder solution in a single app. DUE MAY 1 2021 OR FISCAL YEAR FILERS. State Form Number Description Rev.

Create an account using your email or sign in via Google or Facebook. At present Virginia TAX does not support International ACH Transactions IAT. We will update this page with a new version of the form for 2023 as soon as it is made available by the Virginia government.

Estimated income tax. Ad Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now. You can download or print current or past-year PDFs of Form 760ES-2019 directly from TaxFormFinder.

Ad Register and Subscribe Now to work on your IRS Form 2210 more fillable forms. Please note a 35 fee may be assessed if your payment is declined by your financial institution as authorized by Code of Virginia. 1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details.

2021 Form 760C - Underpayment of Virginia Estimated Tax by Individuals Estates and Trusts 760C - 2021 Underpayment of Virginia Estimated Tax by Individuals Estates and Trusts Enclose this form with Form 760 763 760PY or 770. Check here if this is your first payment for this taxable year. Upload the PDF you need to eSign.

Determine your estimated tax using the instruction brochure Form IT-140ESI Write the amount of your payment on this form. You can download or print current or past-year PDFs of Form 760ES directly from TaxFormFinder. We last updated the VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in January 2022 so this is the latest version of Form 760ES fully updated for tax year 2021.

2021 FORM 770ES - Voucher 1 Doc ID 772 VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHER FOR ESTATES TRUSTS AND UNIFIED NONRESIDENTS CALENDAR YEAR FILERS. D your expected estimated tax liability exceeds your withholding and tax credits by 150 or less. You must pay at least 90 of your tax liability during the year by having income tax withheld andor making timely payments of estimated tax.

At present Virginia TAX does not support International ACH Transactions IAT. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. We last updated the 760ES - VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in February 2021 so this is the latest version of Form 760ES-2019 fully updated for tax year 2021.

Please enter your payment details below. Click IAT Notice to review the details. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc.

Please note a 35 fee may be assessed if your payment is declined by your financial institution as authorized by Code of Virginia.

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Nonresident Real Property Estimated Income Tax Payment Form 2021 It 2663 Pdf Fpdf

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Customizing Invoices Within Quickbooks Online

Printing Estimate Vouchers And Entering Estimates Paid

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

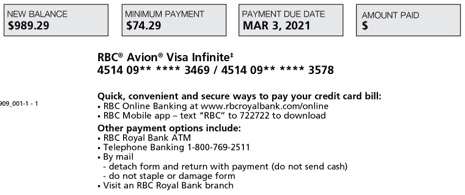

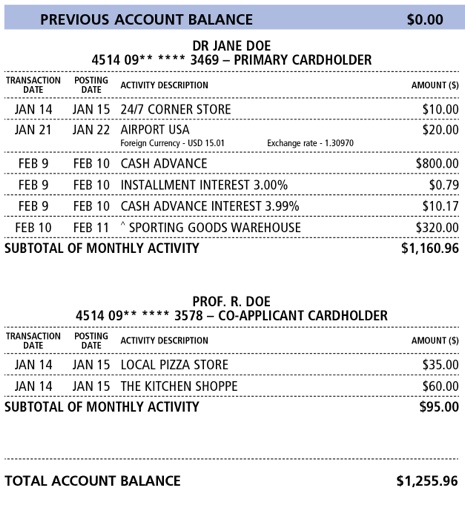

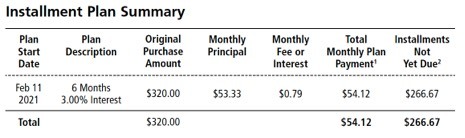

How To Read Your Credit Card Statement Rbc Royal Bank

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

How To Read Your Credit Card Statement Rbc Royal Bank

How To Read Your Credit Card Statement Rbc Royal Bank

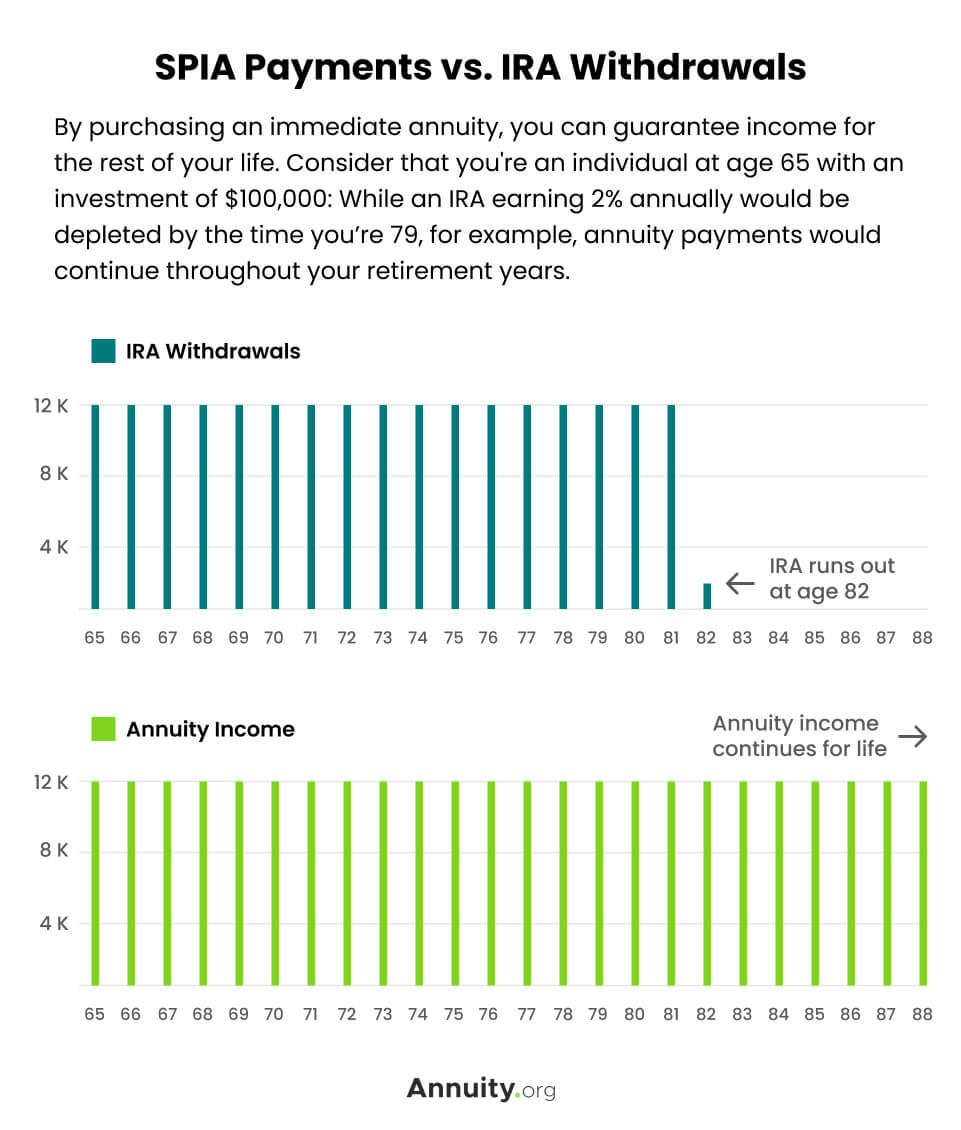

Single Premium Immediate Annuity Spia Rates Pros Cons

File Your Sales Tax Return And Record Sales Tax Payments In Quickbooks Online

Canada Child Benefit Vs The Universal Child Care Benefit 2022 Turbotax Canada Tips